Our Service to You

Bookkeeping

Accurate bookkeeping is an important part of a business, and helps business owners make informed decisions. Whether it's managing your income and expenditure, bank reconciliation or making sure everything balances and is being accounted for correctly, we can help.

Payroll

We offer an end to end payroll service including weekly or monthly pay, pension auto enrolment, RTI to HMRC, payslips, P45's & P60's etc.

CIS

Helping you manage your deductions and liabilities within the construction industry scheme. We perform subcontractor verifications and monthly CIS returns to HMRC for contractors, as well as helping subcontractors to manage their deductions. We also make sure that domestic reverse charge VAT is applied accordingly.

VAT

Monthly or quarterly VAT return service, including filing with HMRC and making sure transactions are accurate. We also offer VAT registration services.

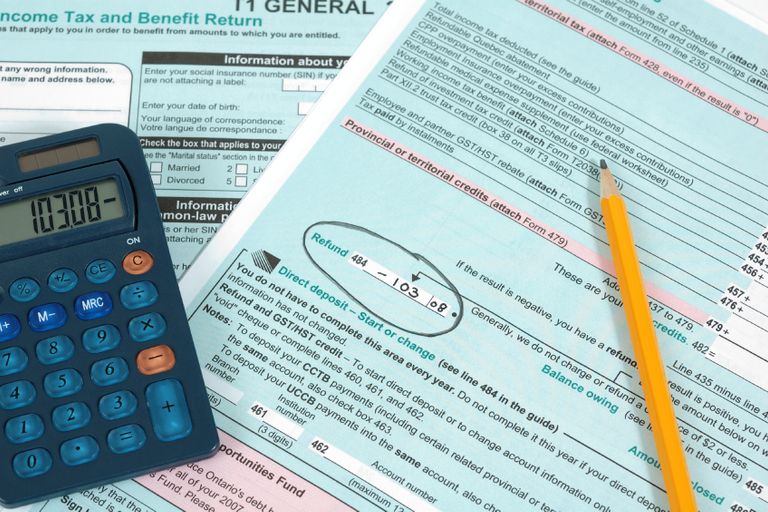

Self Assessment Tax

We offer self assessment tax return services to both individuals, sole traders and partnerships alike. We will advise you of the expenses you are able to claim to reduce your tax liability, whist making sure that you are compliant within the taxation rules.

Sole Trader & Partnership Accounts

As well as self assessment, we can produce annual accounts for our sole trader and partnership clients. These include a profit & loss and balance sheet report, providing useful insights on the yearly performance for small business owners.

Company Accounts

For our Ltd company clients, we compile annual company accounts, which include a profit & loss and balance sheet (the same as our Sole Trader & Partnership accounts), along with more detailed reports to fulfil statutory requirements. These are then filed to Companies House.

Corporation Tax

Once we have compiled Ltd company accounts, we then calculate any corporation tax owed to HMRC. We mitigate any tax where possible whilst staying compliant within the law to enhance tax savings.

Management Accounts

Management accounts are a useful tool when you are trying to track and grow your business cash flows. Xero software, also has a great tracking category feature if there is a specific area of your business you want to focus on.

© Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.